Beautiful Work Foreign Currency Translation Income Statement

:max_bytes(150000):strip_icc()/McDonalds2-6b86f4b9fa604684bc1ee689eb81b799.jpg)

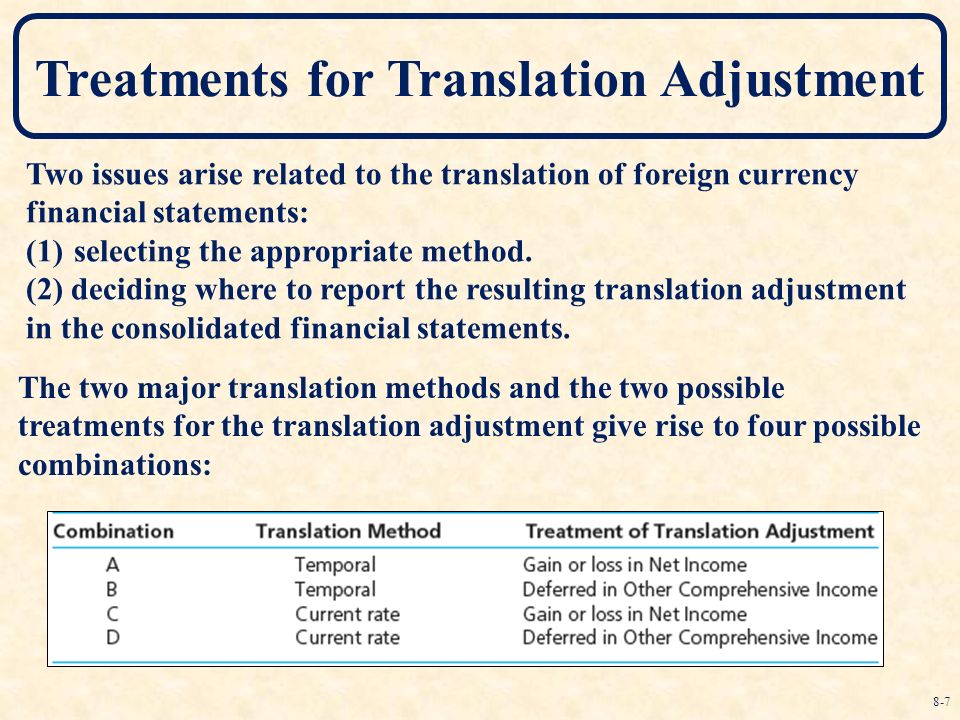

Assets and liabilities are translated at the current rate.

Foreign currency translation income statement. The ending rate for the period The ending rate for the period is the exchange rate at the end of the financial period. The financial statement translation process would consist of the following steps. What is Foreign Currency Translation.

Foreign currency translation is used to convert the results of a parent companys foreign subsidiaries to its reporting currency. The foreign currency gain is recorded in the income section of the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. This is a key part of the financial statement consolidation process.

You need to ensure that all your financial statements use the reporting currency. Determine the functional currency of the foreign entity. In the income statement the revenue and expenses are translated at the average rate for the year rate at date of transactions if significant fluctuations in exchange rate and are retranslated to the closing rate in the statement of financial position.

Statement of Comprehensive Income. For example if a US company has a subsidiary in Germany with the euro as its functional currency the subsidiaries financial statements would need to be translated into US dollars to be consolidated by the parent. Foreign Currency Translation Process.

Tracking of translation differences in equity. Ad Translation of Economic and Financial Documents. The appropriate amount of cumulative translation difference relating to an entity is transferred to the income statement on disposal of that foreign operation and included in the gain or loss on the sale.

Translation of Foreign Currency Financial Statements- Hyper-Inflation Highly inflationary economics include those with cumulative inflation of 100 or more over a three year period. The average rate for the period is used for translation currencies for income statement accounts. Retained earnings is balanced per the equation previously cited.